WHO WE ARE

Demetra Holdings Plc (‘Demetra’) is listed on the Main Market of the Cyprus Stock Exchange and is a member of the FTSE/CySE20 index and apart of the listed entity, Demetra group includes a number of subsidiaries.

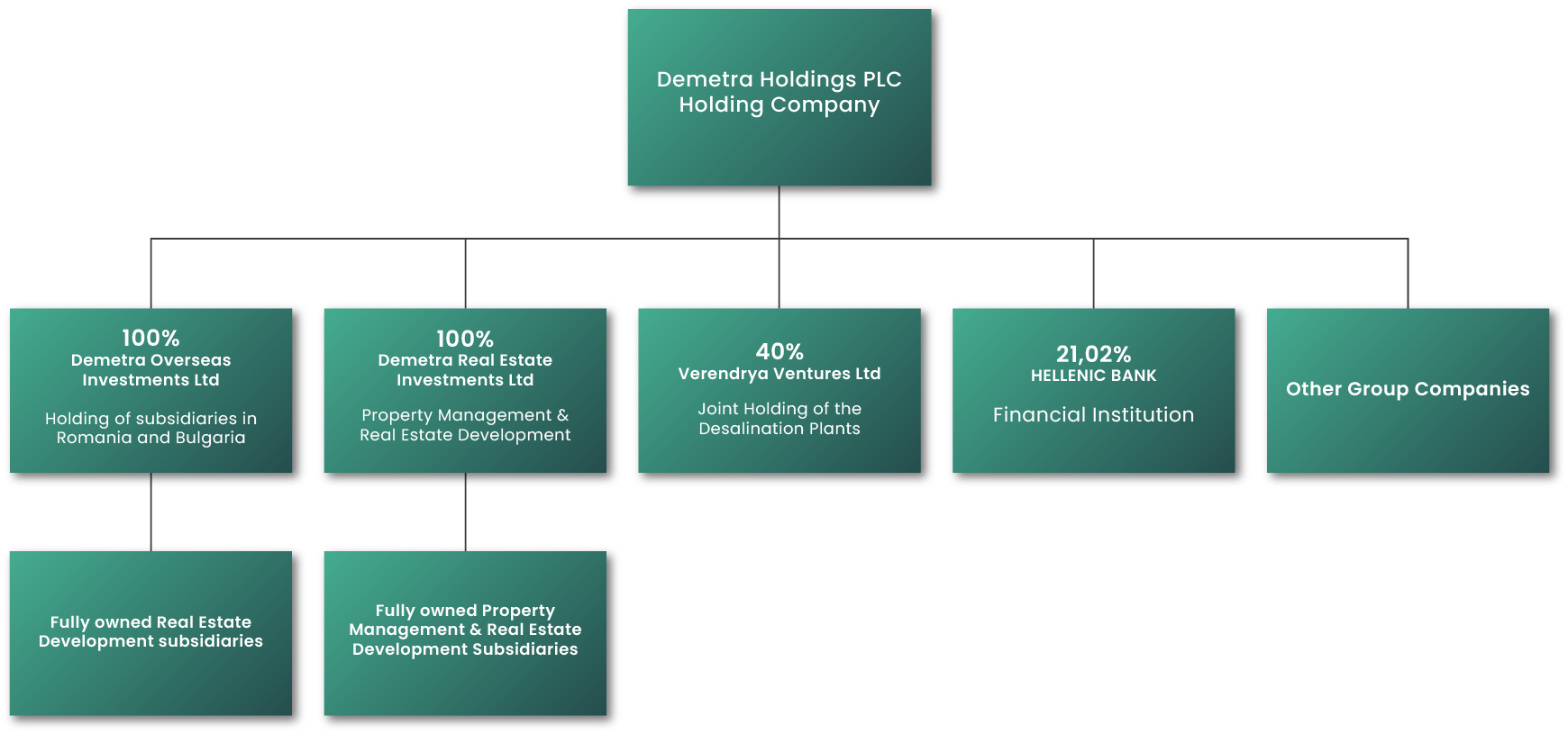

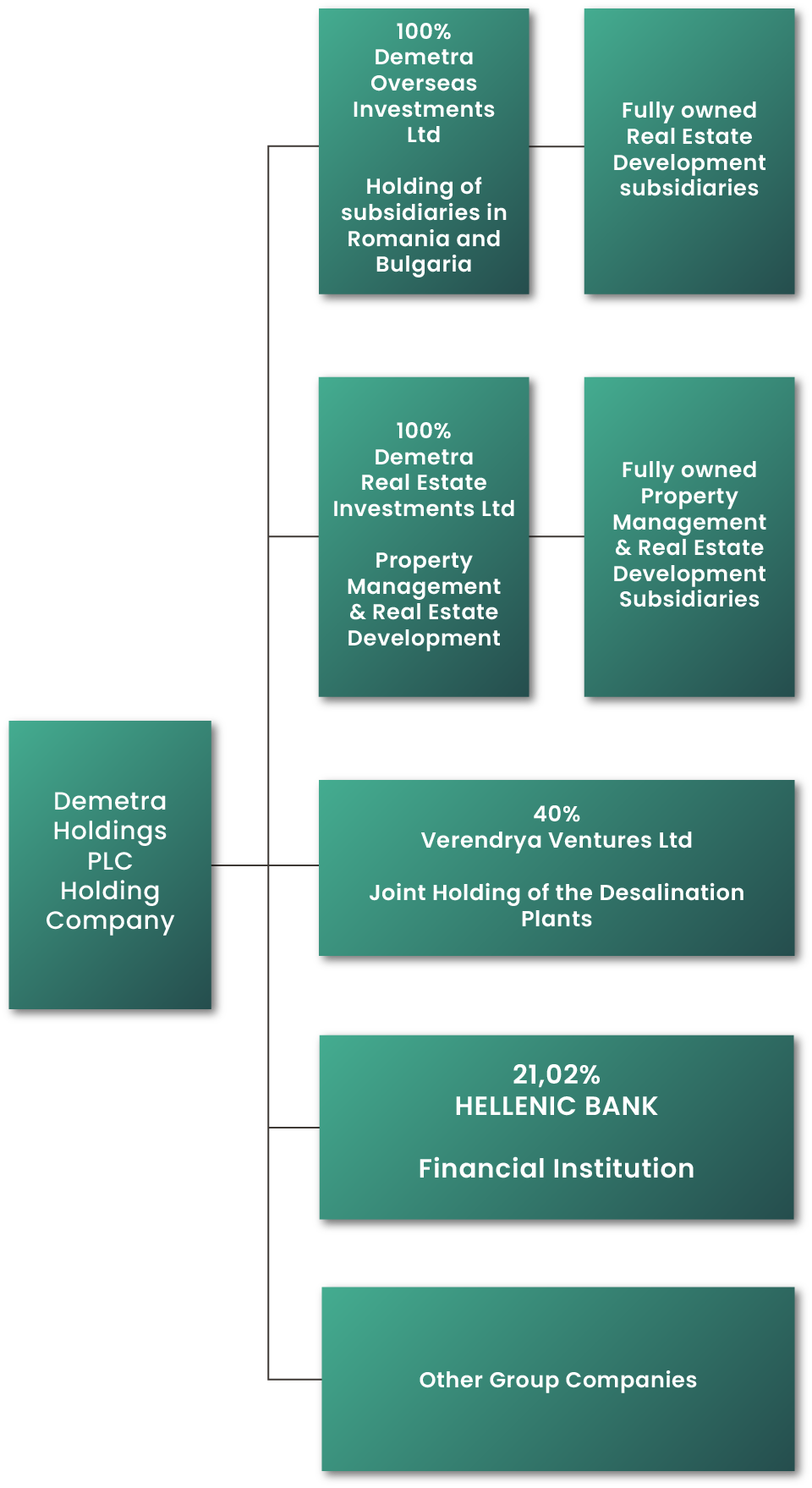

Demetra is a holding company with interests in Equity Holdings, Real Estate Holdings and Private Equity Holdings. The group engages, amongst others, in real estate management and development, in the development, operation and management of sea-water desalination plants jointly with other stakeholders and holds stakes in other private or listed entities.

In relation to the latter, Demetra holds a 10.3% stake in Logicom Public Ltd and more than 20% in Hellenic Bank Public Company Ltd, the second largest banking institution on the island (making it Hellenic Bank’s largest shareholder).

Demetra Holdings PLC prides itself on its culture of integrity, innovation, vision, and value creation, maintaining its position as a market leader in Cyprus.

VISION

We seek to hold a diverse business portfolio, while managing risk, with a goal of providing shareholders with sustainable long-term returns.

MISSION

To be a market leader in Cyprus, in terms of business portfolio and return to shareholders.

To create additional value to our shareholders.

To promote growth opportunities for the Cyprus economy.

WHO WE ARE

Demetra Holdings Plc (‘Demetra’) is listed on the Main Market of the Cyprus Stock Exchange and is a member of the FTSE/CySE20 index and apart of the listed entity, Demetra group includes a number of subsidiaries.

Demetra is a holding company with interests in Equity Holdings, Real Estate Holdings and Private Equity Holdings. The group engages, amongst others, in real estate management and development, in the development, operation and management of sea-water desalination plants jointly with other stakeholders and holds stakes in other private or listed entities.

In relation to the latter, Demetra holds a 10.3% stake in Logicom Public Ltd and more than 20% in Hellenic Bank Public Company Ltd, the second largest banking institution on the island (making it Hellenic Bank’s largest shareholder).

Demetra Holdings PLC prides itself on its culture of integrity, innovation, vision, and value creation, maintaining its position as a market leader in Cyprus.

VISION

We seek to hold a diverse business portfolio, while managing risk, with a goal of providing shareholders with sustainable long-term returns.

MISSION

To be a market leader in Cyprus, in terms of business portfolio and return to shareholders.

To create additional value to our shareholders.

To promote growth opportunities for the Cyprus economy.

BOARD OF DIRECTORS

MANAGEMENT TEAM

Dr. Cleanthis (Athos) Chandriotis

Dr. Cleanthis (Athos) Chandriotis studied at the English School, Nicosia and after fulfilling his military obligations, he then moved to the United Kingdom where he studied at the University of Manchester Institute of Science and Technology (UMIST), where he graduated with honours in Mechanical Engineering (BEng Upper Second Honours). Subsequently, he attended the two-year, full-time MBA program of Manchester Business School (Director’s List). He holds a PhD in Economics from Durham University in the UK. He holds a postgraduate Diploma in Marketing (DipM) from the Chartered Institute of Marketing (UK). He was the General Manager of Laiki Financial Services Ltd and a non-executive member of the Board of Directors of Investment Bank of Greece (now Optima Bank). He has also worked at HSBC Investment Bank plc in London in the Project Finance and Advisory Division specializing in Public-Private Partnership (PPPs) projects. Until recently, he was the General Manager and Executive Member of the Board of Directors of The Cyprus Investment and Securities Corporation Ltd (CISCO), a subsidiary (CIF) of the Bank of Cyprus. For several years he has been a member of a multitude of Investment and Credit Committees and an executive and non-executive member of Boards of public and private companies and organisations, both locally and abroad. Dr. Chandriotis has also taught for several years at both undergraduate and postgraduate level in colleges and universities in Cyprus. Dr. Chandriotis has over the years advised companies and organisations in various sectors of the economy on matters of financial strategy and capital raising. He was the reviewer of the examination workbooks and solution manuals provided by the Cyprus Securities and Exchange Commission in collaboration with the Chartered Institute for Securities and Investment (CISI) of the United Kingdom, and the Cyprus International Institute of Management (CIIM) concerning the Commission’s institutional framework for regulating financial services in Cyprus. He has extensive experience and deep knowledge of the Capital Markets as well as Banking and Financial affairs.

Costas Paphitis - CFO

Mr. Paphitis graduated from Archbishop Makarios III Lyceum (Nicosia) in 1994, and received his Bachelor Degree (BSc (Hons)) in Accounting and Finance from the University of Warwick in the UK in 1999. He then continued his studies as a Trainee Chartered Accountant in the Audit Department of KPMG in Nicosia and after qualification as a Chartered Accountant he was promoted to a supervisor and subsequently to a manager in the Audit Department of KPMG. In 2006 he has been appointed as a Chief Financial Officer of Demetra Holdings Plc, the largest investment company in Cyprus, a position he holds until today. He is a Member of the Institute of Chartered Accountants in England and Wales (ICAEW) since 2003 and a Member of the Institute of Certified Public Accountants in Cyprus (ICPAC) since 2004.

GROUP STRUCTURE

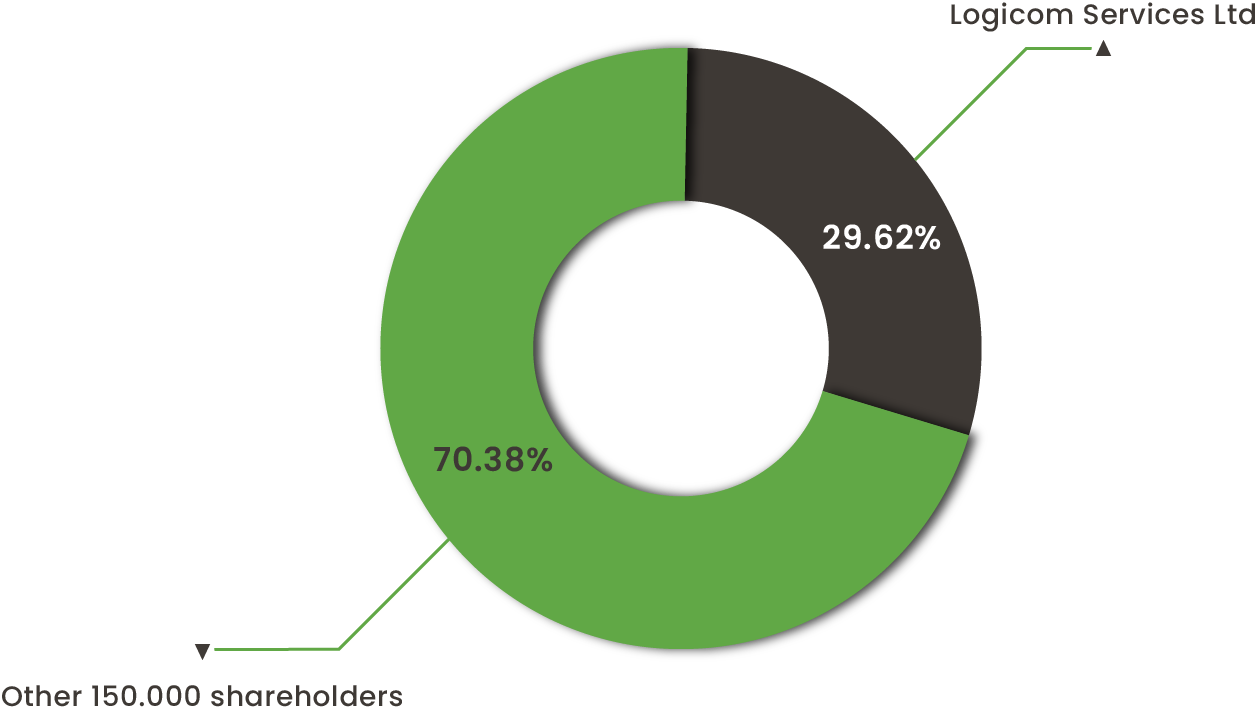

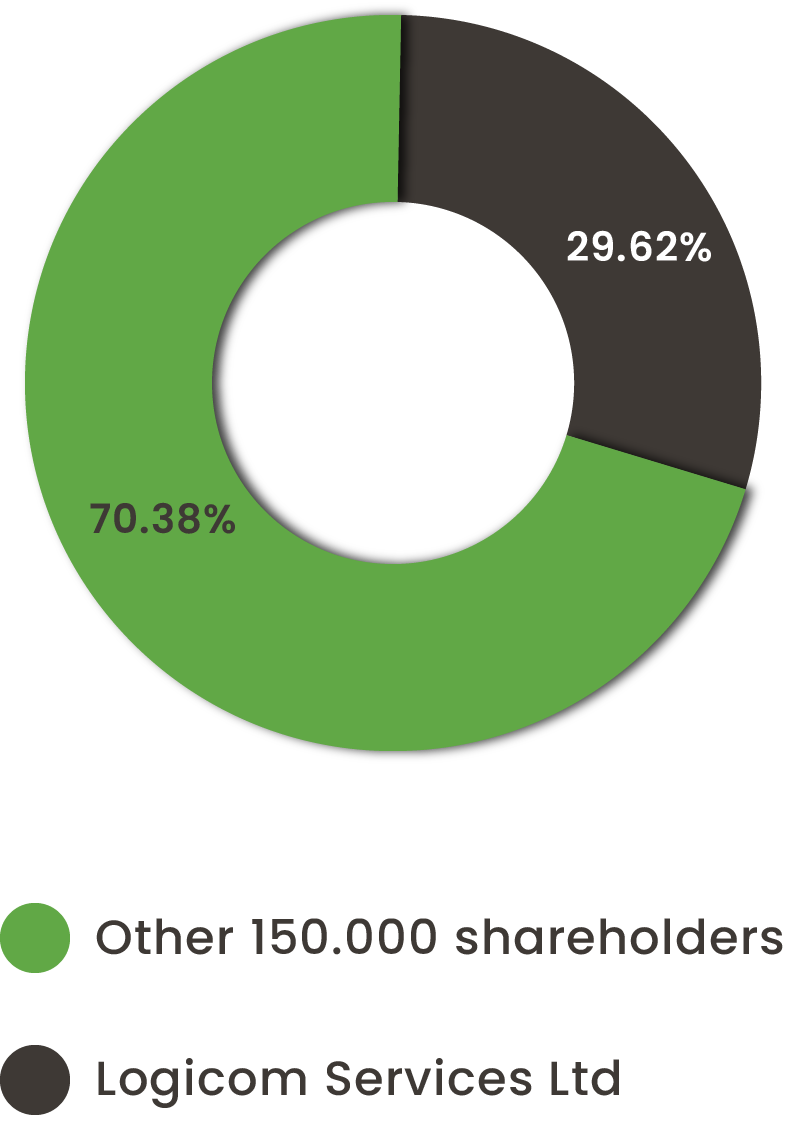

SHAREHOLDING